2021 Import and Export Calculation and Recent Development of China's Cutting Tool Market

- Categories:Tungsten Carbide Rods

- Author:

- Source:

- Time of issue:2022-06-13

- 访问量:0

【概要描述】The Tool Branch of China Machine Tool and Tool Industry Association conducted a survey and analysis of the total consumption scale and import and export volume of China's tool market in 2021 based on statistical data from member units, customs data

中国刀具市场2021年进出口测算及近年发展情况

【概要描述】中国机床工具工业协会工具分会根据会员单位的统计数据、海关数据、刀具原材料统计数据、刀具聚集区数据等的调查及分析,对我国2021年刀具市场消费总规模和进出口量进行了测算。

- 分类:行业动态

- 作者:

- 来源:中国机床工具工业协会cmtba

- 发布时间:2022-06-13

- 访问量:0

1. Estimated Total Consumption, Imports and Exports of China’s Cutting Tool Market in 2021

Based on the survey and analysis of statistical data from member units, customs data, statistical data on cutting tool raw materials, and data from cutting tool clusters, the Cutting Tool Branch of the China Machine Tool & Tool Builders’ Association (CMTBA) has estimated the total consumption scale and import/export volume of China’s cutting tool market in 2021.

-

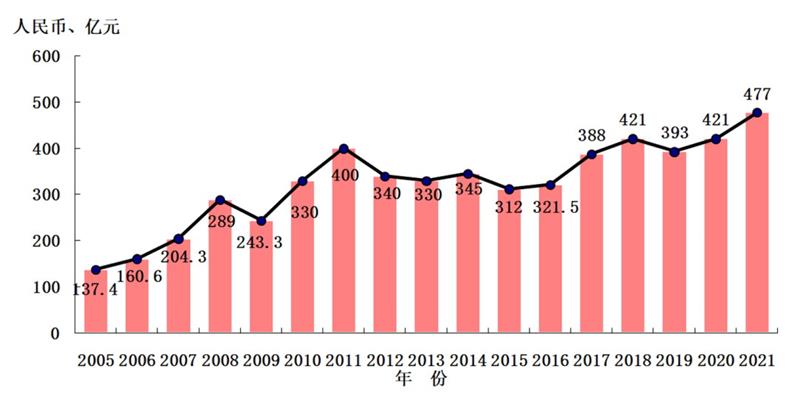

Total Consumption Scale of China’s Cutting Tool Market in 2021

The total consumption scale of China’s cutting tool market increased from RMB 42.1 billion in 2020 to RMB 47.7 billion in 2021, a year-on-year increase of 13.3% (Figure 1), hitting a new high. Among this total: domestic cutting tools accounted for approximately RMB 33.9 billion, or 71% of the market, up 17% year-on-year; imported cutting tools (including foreign brands produced and sold in China) reached RMB 13.8 billion, or 29% of the market, up 5.3% year-on-year. Domestic cutting tools achieved substantial growth in the Chinese market, with their market share increasing by 2 percentage points compared with 2020. After declining for two consecutive years, imported cutting tools saw modest growth, with their market share dropping by 2 percentage points compared with 2020.

Figure 1: Changes in the Size of China’s Cutting Tool Market, 2005–2021

Domestic production and sales (domestic sales + exports) of cutting tools: 2018 (27.3 billion + 18.0 billion) = 45.3 billion; 2019 (25.7 billion + 18.4 billion) = 44.1 billion, a year-on-year decrease of 2.6%; 2020 (29.0 billion + 18.0 billion) = 47.0 billion, a year-on-year increase of 6.6%; 2021 (33.9 billion + 22.5 billion) = 56.4 billion, an increase of 20%.

-

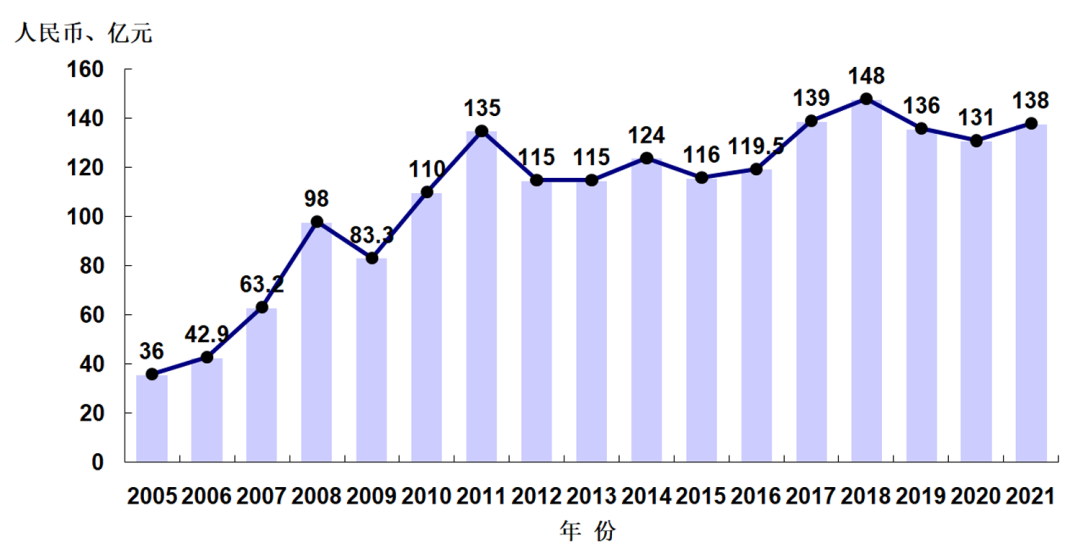

Scale of Imported Cutting Tools (Foreign Brands) in 2021

The total import value of cutting tools in China (including foreign brands produced and sold in China) increased from RMB 13.1 billion in 2020 to RMB 13.8 billion in 2021, a year-on-year increase of 5.3% (Figure 2).

There are certain differences between the import data and customs data (including year-on-year growth rates) because the statistical calibers are not completely consistent, and foreign brands have production and sales operations in China.

Figure 2: Changes in China’s Cutting Tool Imports, 2005–2021

-

National Cutting Tool Export Scale in 2021

China’s cutting tool exports increased from RMB 18.0 billion in 2020 to RMB 22.5 billion in 2021, a growth rate of 25.45%.

2. Development of China’s Cutting Tool Industry in Recent Years

Based on statistical data and survey analysis, the following is an introduction to the development of cutting tool varieties with relatively large production and sales volumes in China in recent years (2018 to 2021).

-

Domestic Cutting Tools Have Made Significant Progress

According to estimates by the Cutting Tool Branch, the domestic market share of Chinese-made cutting tools increased from 65% in 2018 to 71% in 2021. The export value of cutting tools remained basically stable from 2018 to 2020, and increased by 25.45% in 2021.

-

Rapid Growth of Cemented Carbide Cutting Tools

With the advancement of China’s manufacturing industry, the demand for cemented carbide cutting tools has been continuously increasing. At the same time, in recent years, China’s cemented carbide cutting tool industry has made remarkable progress in materials, coatings, process equipment, etc., driving rapid expansion of production capacity, and attracting capital attention, which has accelerated the capacity expansion process.

Among cemented carbide cutting tools, the two categories with large production and sales volumes and rapid development are: one is solid cemented carbide round-shank tools (hereinafter referred to as solid carbide tools), mainly end mills and drills; the other is indexable inserts.

(1) Solid Carbide Tools Experienced Sharp Fluctuations

The main application fields of solid carbide tools are: 3C (represented by mobile phones), molds, transportation, aerospace, etc. China is a major producer of mobile phones, resulting in huge consumption of solid carbide tools, which is also one of the main reasons why international tool giants have accelerated the acquisition of solid carbide tool enterprises in China.

The 3C industry, represented by mobile phones, is highly cyclical with rapid product design updates, leading to significant fluctuations in the demand for such tools. There was rapid growth in 2017 and 2018, a sharp decline in 2019, a quick rebound in 2020, rapid growth in the first half of 2021, and a slowdown in the second half.

The raw material for such tools is cemented carbide rods, and the market demand can be seen from the output of rods. The national annual output of rods: 2018 – 11,000 tons; 2019 – 8,321 tons, a significant decrease; 2020 – 11,000 tons; 2021 – 14,600 tons.

The entry barrier for solid carbide tools is relatively low, with CNC tool grinders as the main processing equipment. The rapidly growing market demand has led to rapid expansion of production capacity for such tools, and a large number of small and micro enterprises have started to produce them, resulting in fierce price competition and weak profitability for some enterprises.

In high-end application fields such as aerospace, however, imported brands still dominate.

(2) Sustained Growth of Indexable Inserts

Indexable inserts are products with relatively high added value and also the largest imported cutting tool variety. In recent years, the production and sales of indexable inserts in China have continued to grow, even maintaining growth in 2019 when the entire industry was in adjustment.

According to surveys, the production and sales volume of indexable inserts in China were 235 million pieces in 2018, 250 million pieces in 2019, 300 million pieces in 2020, and 450 million pieces in 2021. From 2021 to 2022, capacity expansion further accelerated.

Cemented carbide cutting tools (mainly inserts) are one of the largest imported cutting tool varieties in China, accounting for about 40%. According to customs data, in 2021 China imported 638 tons of coated cemented carbide cutting tools (mainly inserts) and 680 tons of uncoated cemented carbide cutting tools (including some inserts). Based on this, it is estimated that the number of imported inserts exceeded 100 million pieces. In 2021, the average unit price of imported coated cemented carbide cutting tools (mainly inserts) was RMB 4,251.36/kg, while the average unit price of exported coated cemented carbide cutting tools (mainly inserts) was RMB 1,116.79/kg.

According to the 2021 Annual Report of the Cutting Tool Branch, the average unit price of indexable inserts in the industry was less than RMB 7/piece.

China’s indexable inserts are cost-effective and have made great contributions to improving the efficiency of the manufacturing industry. Due to their high added value, most insert manufacturers currently have good profitability. However, the product has a relatively long process chain from granulation, pressing, sintering, grinding to coating, requiring large equipment investment, and is a capital-intensive product. Moderate capacity expansion can promote competition and facilitate high-quality industrial development; however, excessive expansion is not conducive to the sustained and healthy development of the industry.

The main gaps between such products and the international advanced level lie in original solutions and supporting capabilities, services, and quality stability, which are also important reasons for the huge price difference between domestic and foreign inserts.

-

HSS Cutting Tool Market Remained Basically Stable

From 2018 to 2020, the output of high-speed steel (HSS) in China remained basically stable, with a slight increase in 2021. In terms of HSS cutting tools, there were not many new enterprises entering the industry in recent years, the industrial structure changed little, and the leading enterprises maintained stable profitability.

The relatively advantageous varieties among HSS cutting tools are mainly taps, broaches, and medium-module gear cutting tools, among which taps have the largest production and sales volume. In 2021, China imported taps worth RMB 1.07 billion and exported taps worth RMB 0.78 billion (including a small amount of alloy steel taps), with the import and export unit prices differing by 10 times. High-end taps have great market potential, which is also one of the reasons why some enterprises have newly entered the tap product field.

In terms of product mix changes, small and medium-sized HSS drills and end mills have been partially replaced by solid carbide tools, while medium and large-sized drills, end mills, and gear cutting tools have been partially replaced by indexable cemented carbide tools.

The development of HSS cutting tools in recent years has mainly been reflected in the progress of raw materials, process equipment, and optimization in segmented fields.

About 40% of China’s total cutting tool production capacity is for export, among which drills have the largest export volume, accounting for nearly 40%. In 2021, China exported drills worth RMB 8.6 billion, mainly HSS (including alloy HSS) drills. China is a major producer of such tools, and the main export enterprises have stable profitability.

扫二维码用手机看

Contact

Address:Contact

Tel:+86-190 6712 9860

Fax:+86-190 6712 9860

E-mail pm@csu-pm.com

Copyright © Hunan Boyun-Dongfang Powder Metallurgy Co., Ltd All Rights Reserved. Hunan ICP No. 2022013114-1